south san francisco sales tax 2019

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2019 as defined in Code section. The South San Francisco California sales tax is 750 the same as the California state sales tax.

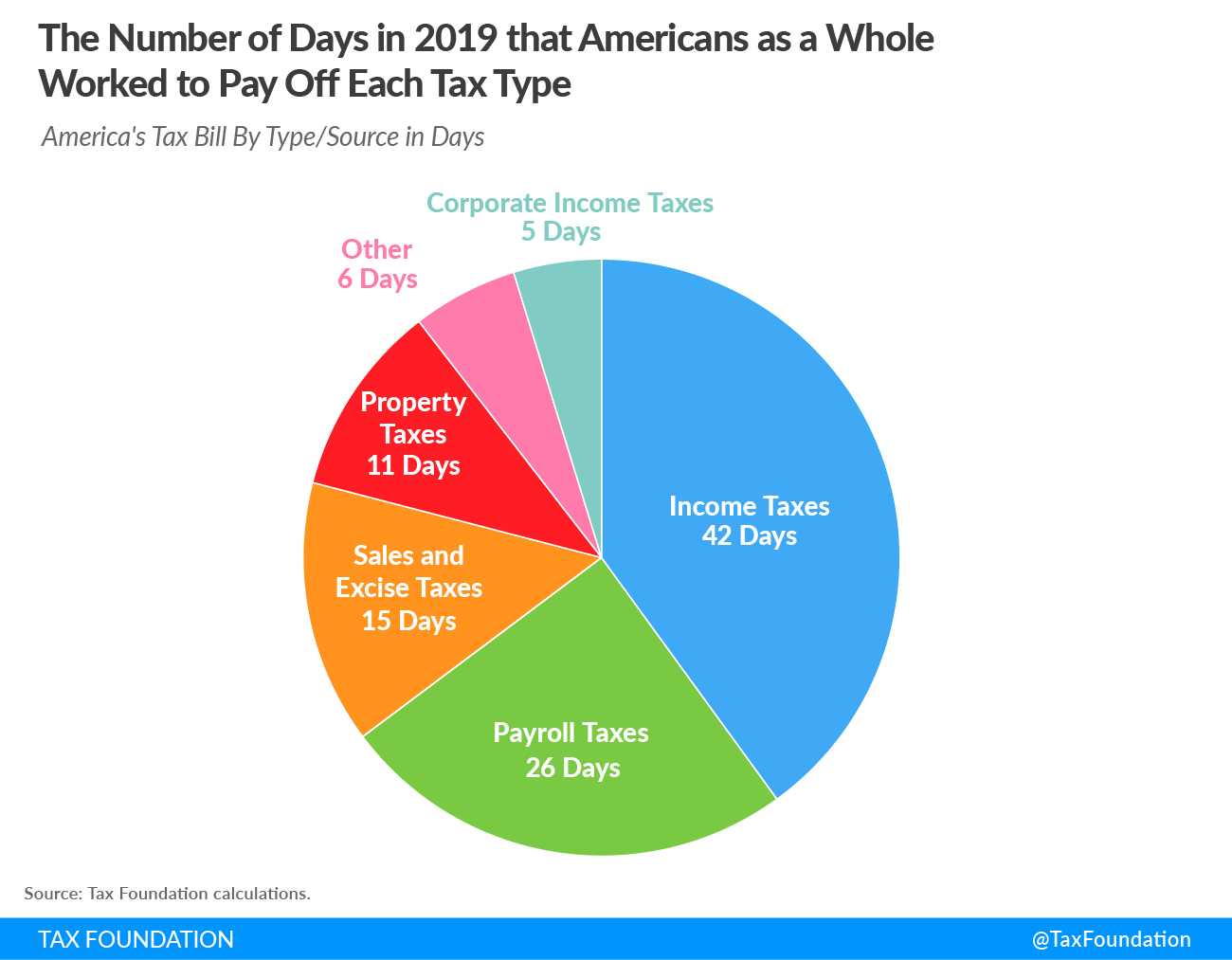

State And Local Sales Tax Rates Sales Taxes Tax Foundation

The phone number for general tax questions is 1-800-400-7115.

. South Shore Alameda 10750. The December 2020 total local sales tax rate was 8500. CA Sales Tax Rate.

South san francisco in. The South San Francisco Sales Tax is collected. San Francisco CA Sales Tax Rate.

Currently the cumulative tax on retail sales in South San Francisco is 9 of the purchase price. While many other states allow counties and other localities to collect a local option sales tax. The December 2019 total local sales tax rate was also 8500.

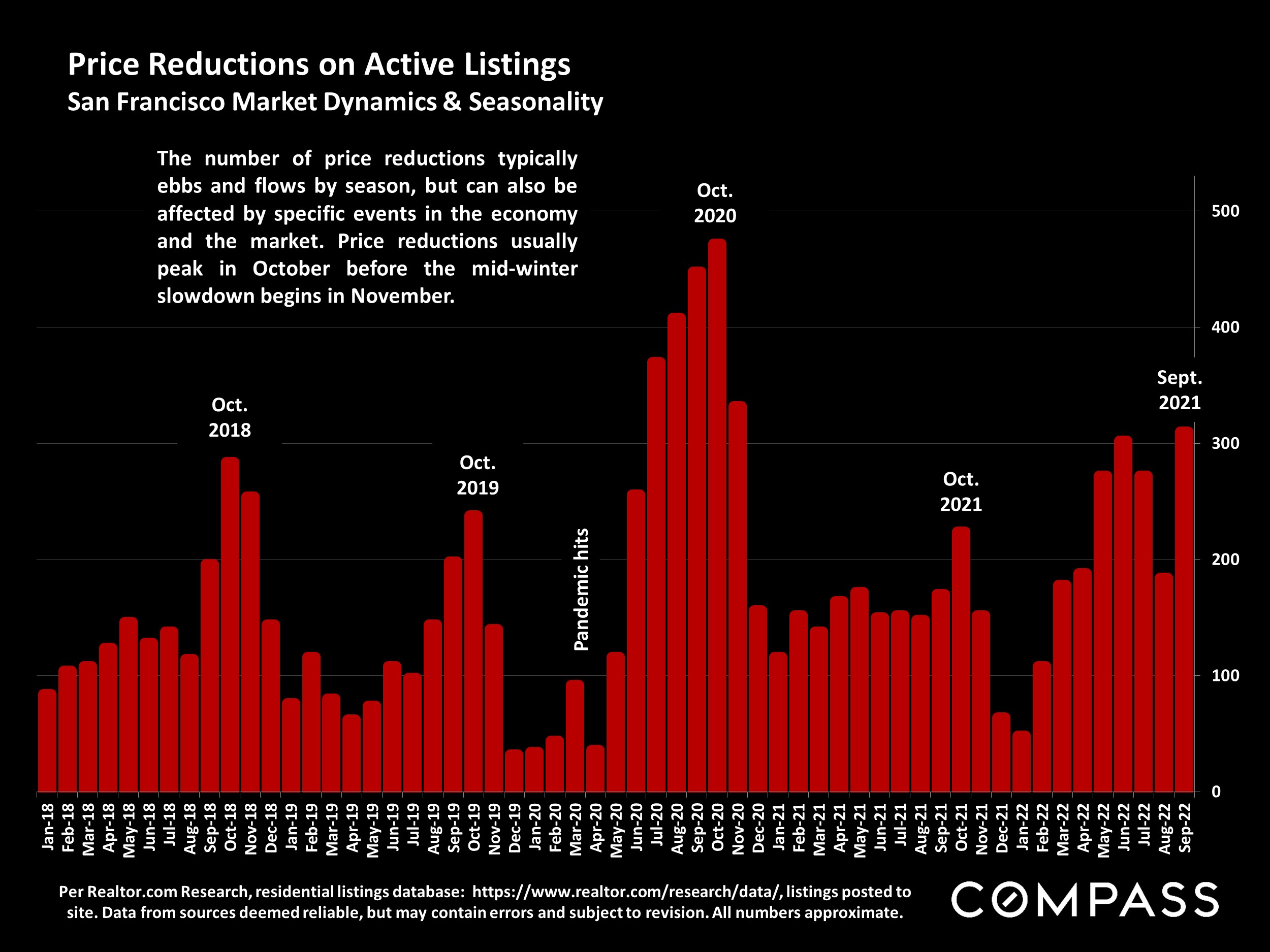

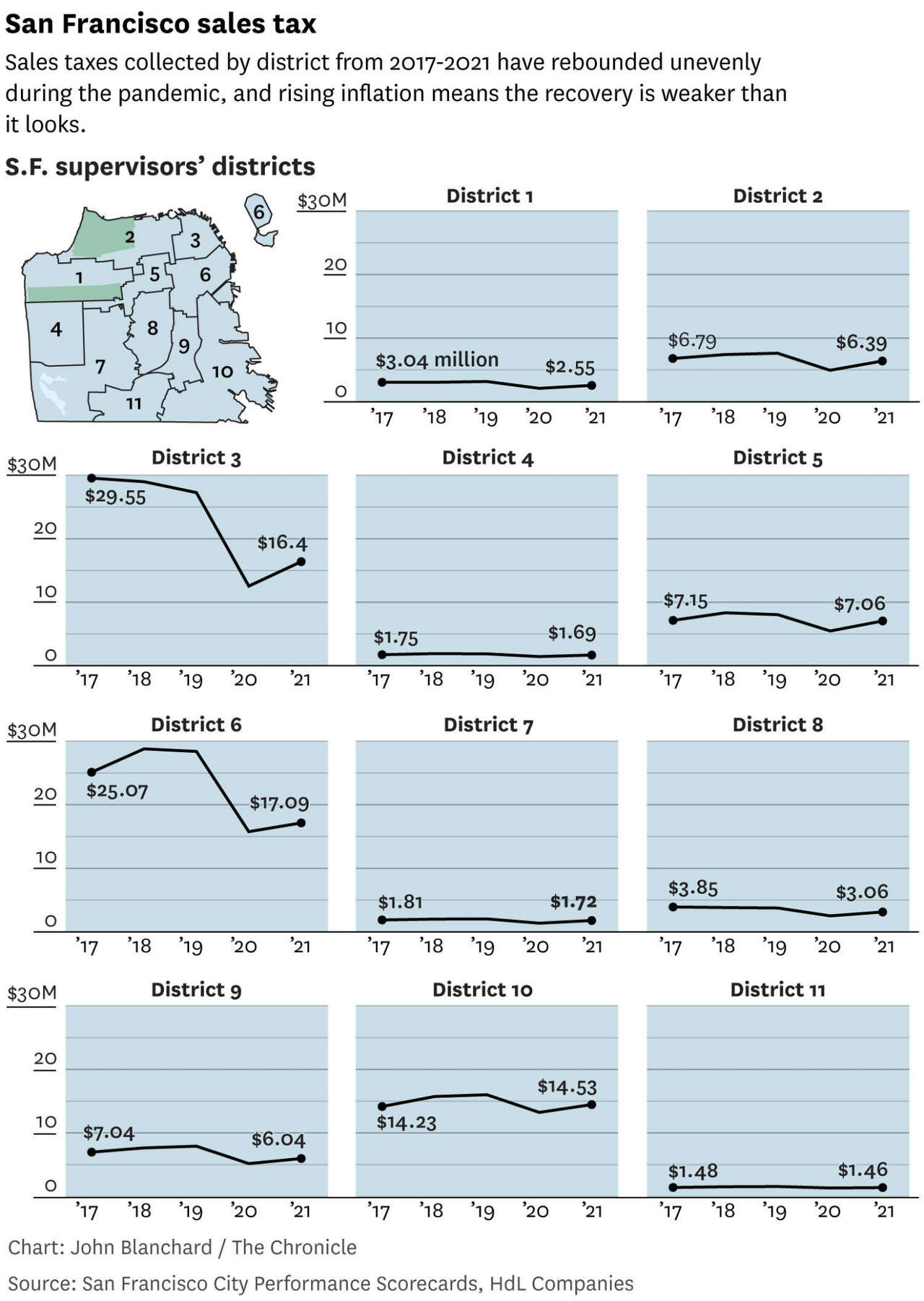

The minimum combined sales tax rate for San Francisco California is 85. San Franciscos total sales tax revenue dropped by more than 46 between 2019 and 2020 from 165 million to 88 million. The current total local sales tax rate in San Francisco CA is 8625.

This is the total of state. The December 2020 total local sales tax rate was 9750. Next to city indicates incorporated city City Rate.

What is the sales tax rate in South San Francisco California. South Laguna Laguna Beach. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

South San Francisco 5 Sales Tax. South El Monte 10250. November 2018 Elections - Santa Clara.

However while sales tax data has. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and. In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled.

The current total local sales tax rate in South San Francisco CA is 9875. There is no applicable city tax. The california sales tax rate is currently 6.

South Dos Palos. South San Francisco. The minimum combined 2022 sales tax rate for South San Francisco California is.

California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note. Measure W authorized the city to impose a 05 percent sales tax for 30 years. Case in point.

On a taxable sales transaction of one dollar South San Francisco currently. ELECTION 2014 - June 3 San Benito County ballot measures. This is the total of state county and city sales.

Homeowners Property Taxes Grew Faster During Pandemic

State Corporate Income Tax Rates And Brackets For 2019

All Reports Record Of Our Previous Work Startup Genome

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

San Francisco Home Prices Market Conditions Trends Compass

![]()

Tracking The San Francisco Tech Exodus Sf Citi

Tax Freedom Day Tax Foundation

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Izzy S At Night Picture Of Izzy S Steaks Chops San Francisco Tripadvisor

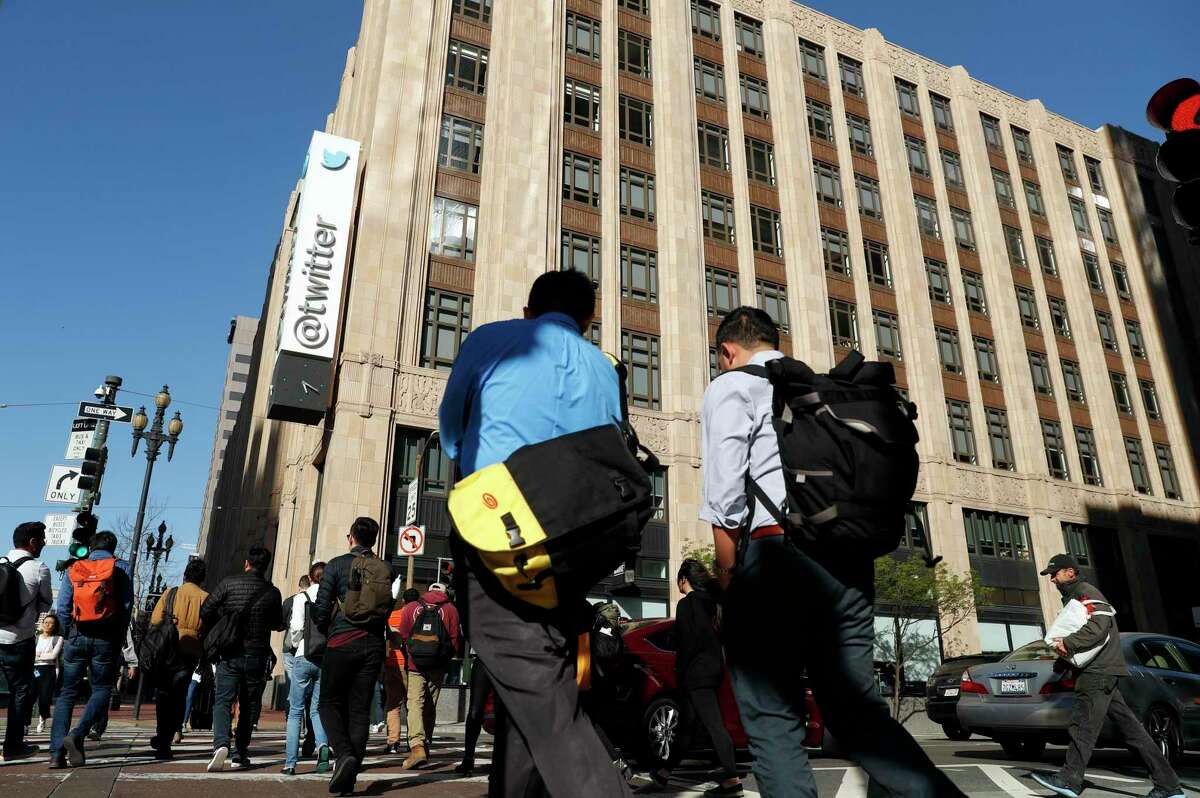

How Downtown Sf Can Bounce Back Amid Twitter Turmoil Uber S Departure

Pdf Retailers Perspectives On Selling Tobacco In A Low Income San Francisco Neighbourhood After California S 2 Tobacco Tax Increase

The City Of South San Francisco Government South San Francisco Ca Facebook

Frequently Asked Questions City Of Redwood City

How To Get Tax Refund In Usa As Tourist For Shopping 2022

Homeless Populations Are Surging In Los Angeles Here S Why The New York Times